What is CO2 ?

Carbon dioxide or CO2, is a naturally occurring gas that is present in everyday conditions in the Earth’s atmosphere. All humans exhale carbon dioxide when they breathe and plants through photosynthesis absorb it to grow. CO2 is a greenhouse gas as it is part of the Earth's atmosphere which keeps the world at a temperature which is liveable.

CO2 is produced from fossil fuels such as coal, peat petroleum and natural gas. Human activities for example such as the burning of fossil fuels release extra C02 (and other greenhouses gases) into the atmosphere, increasing atmospheric C02 leading to problems such as climatic instability.

Vehicle Labelling

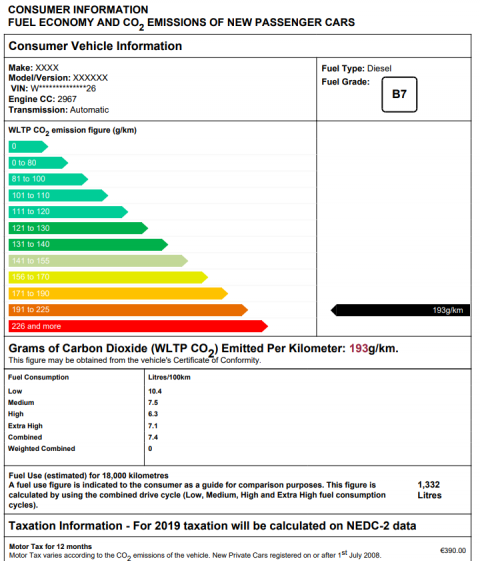

As part of the introduction of the new CO2 based VRT and road tax systems, the motor industry have in consultation with the Department of Environment, established a new colour coded labelling system for new passenger cars. These labels, which are displayed on or near any new car for sale, provide valuable information to assist consumers in making their environmental decision with details on the CO2/km for the car, the appropriate VRT and motor tax rates and fuel usage and consumption information.

CO2 Labels

Since the 1st January 2020 a WLTP CO2 label should be displayed beside all new cars that have been prepared for sale and are on show at the point of sale.

The CO2 labels were launched by Mr John Gormley, T.D., Minister for the Environment, as a vital part of the Government CO2 Strategy and to remove a lot of the confusion among consumers regarding the VRT and Road Tax changes that were introduced at the time. The national labelling system has twelve colour-coded bands that should be familiar to consumers from the energy labels already used for certain electrical goods. The overall approach is intended to assist buyers in evaluating the environmental impacts of different cars and provide guidance for them on purchase and running costs. Rather than introduce the new system with penalties for non-compliance, the Department agreed that it should be introduced initially on a non-statutory basis and only apply to new cars on show at the point of sale.

CO2 Emission Guide

Reducing CO2

In 2008 the Irish Government introduced a change to CO2 based taxation to reduce emissions from cars and protect the environment. The motor industry and car buyers supported the change with a huge reduction in the average CO2 emissions of cars sold since July ‘08. A Scrappage Scheme was announced in the December 2009 Budget with an extension into 2011, to incentivise motorists with vehicles over 10 years to change into newer cars.

While the scrappage scheme was successfully, the years that followed seen a decline in new cars sales due to recession, recovery has been slow due to economic factors such as Brexit.

The average age profile of a car in Ireland is 9 years, as motorists have held onto their vehicles for longer. Older cars are not as environmentally friendly as newer cars as many are not fitted with a DPF (Diesel Particulate filter) and negatively impact on the environmental progress which has been made here by the improvement in new car sales since 2013.

The automotive industry is working hard to reduce emissions by investing in more fuel‑efficient technologies and alternative fuel sources. The EU has set targets for reducing CO2 emissions from cars under the 2030 energy and climate package.

The Climate Action Plan 2021 provided a detailed plan for taking decisive action to achieve a 51% reduction in overall greenhouse gas emissions by 2030 and setting us on a path to reach net-zero emissions by no later than 2050, as committed to in the Programme for Government and set out in the Climate Act 2021. Ireland’s first carbon budget programme, comprising three 5-year (2021-2025; 2026-2030; and 2031-2035), economy-wide carbon budgets, was approved by the Government on 22 February 2022 and took effect on 6 April 2022.

How you can help reduce CO2 Emissions

ECO Driving

While the Motor Industry continues to reduce emissions with improvements in technology, other stakeholders also have a vital role to play.

Fuel-efficient driving, or "eco-driving", can significantly reduce fuel consumption and lower CO2 emissions.

- Eco-driving is easy to apply:

- Shift into a higher gear early.

- Maintain a steady speed at highest possible gear.

- Anticipate traffic flow.

- Switch off the engine at short stops.

- Check and adjust the tyre pressure regularly.

- Make use of in-car fuel saving devices such as on-board computers and dynamic navigators.

- Get rid of surplus weight and unused roof racks.

Eco-driving training can lead to a fuel economy of up to 25%, with a significant long-term effect of 7% under everyday driving conditions.