Environmental issues, particularly air quality and climate change, will be a key determinant for the types of car that will be driven, where and when they can be driven, car ownership models and levels, and motor related taxation. Our Industry is a key stakeholder in this debate as we will have an important role in providing technological solutions to environmental challenges. Change can happen with the right measures, but cannot happen overnight, and sensible policies aimed at encouraging motorist to make the right choices can lead to clean affordable and convenient mobility solutions.

C02

Carbon dioxide or CO2, is a naturally occurring gas that is present in everyday conditions in the Earth’s atmosphere. All humans exhale carbon dioxide when they breathe and plants through photosynthesis absorb it to grow. CO2 is a greenhouse gas as it is part of the Earth's atmosphere which keeps the world at a temperature which is liveable.

CO2 is produced from fossil fuels such as coal, peat petroleum and natural gas. Human activities for example such as the burning of fossil fuels release extra C02 (and other greenhouses gases) into the atmosphere, increasing atmospheric C02 leading to problems such as climatic instability.

C02 Label

Since the 1st July 2008, a CO2 label should be displayed beside all new cars that have been prepared for sale and are on show at the point of sale.

The 'car labelling Directive' (Directive 1999/94/EC) aims to

- help consumers evaluate the environmental impacts of different cars as well as the running costs when buying or leasing cars.

- encourage manufacturers to reduce the fuel consumption of new cars.

Ireland's CO2

Car manufacturers to meet their specific CO2 emission targets set by the EU.

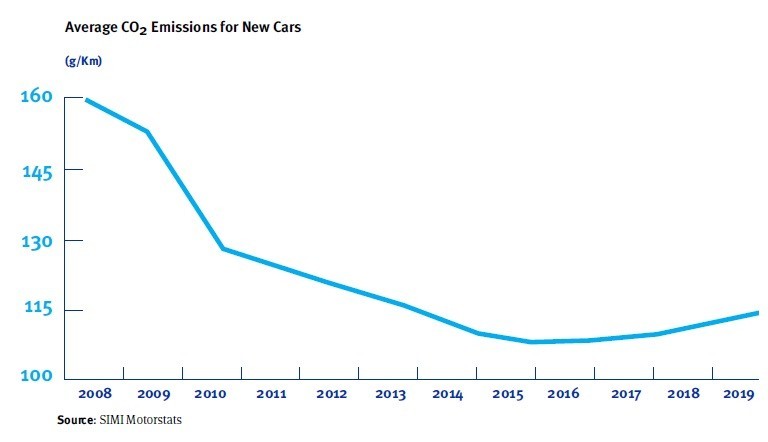

Since the introduction of CO2 based VRT and road tax in 2008, we have seen a 33% (2008 v 2020)

reduction in the average CO2 emissions from new cars registered in Ireland. However, Ireland has not seen the full benefit of that change as new cars sales have been at disappointingly low levels over the last 12 years, even with the strong economic progress Ireland has made since 2014.

Our national car fleet of nearly 2.2 million should have a replacement rate, per European norms, of 7 to 8 per cent per annum to refresh the fleet and prevent it from ageing. This would indicate a “normal” car market in the region of 154,000 to 176,000 each year.

Nitrogen Oxide (NOx) Levy

Nitrogen Oxide (NOx) gases are usually produced from the reaction among nitrogen and oxygen during combustion of fuels. Diesel engines emit more NOx than petrol engines.

What is the Nitrogen Oxide (NOx) Levy?

The NOx levy is a new tax introduced on all vehicles (excluding electrics but including hybrids) registered after 31 December 2019, that are liable for a Nitrogen Oxide (NOx) emissions charge as part of the VRT payable on a car. The charge applies to new car purchases and used imports. This charge replaced the 1 per cent diesel surcharge.

There are two components to Vehicle Registration Tax (VRT), the NOx charge and the CO2 component.

The NOx figure is located on the vehicle logbook (V5) if it is not available on this document then the existing Certificate of Conformity (CoC) should contain a NOx figure. If in doubt a manufacturer may be able to clarify which figure to use.

Charges are applied on a per-milligramme basis, based on a car’s officially recorded emissions of NOx per kilometre. The scale below outlines the amount payable.

Charges are applied on a per-milligramme basis, based on a car’s officially recorded emissions of NOx per kilometre. The scale below outlines the amount payable.

| NOx emissions (NOx mg/km or mg/kWh) | Amount payable per mg/km or mg/kWh |

| The first 0-60 mg/km or mg/kWh, as the case may be | €5 |

| The next 20 mg/km or mg/kWh or part thereof, as the case may be, up to 80 mg/km or mg/kWh, as the case may be | €15 |

| The remainder above 80 mg/km or mg/kWh, as the case may be | €25 |

The NOx charge will be capped at a maximum of €4,850 for diesel vehicles and €600 for other vehicles.

In order to register a vehicle, a person must first book an appointment at an NCTS centre to have the vehicle examined to ascertain whether or not it meets the definition of mechanically propelled vehicle for VRT purposes. Visit the NCT website where the have further information on the VRT process in their FAQ section.

Calculating the NOx charge

Carbon Dioxide charge + NOx Charge = Total VRT payable.

The Revenue Commissioners website provides a calculator that will help determine an estimate of the charge payable, the potential NOx levy for the vehicle. Their spreadsheet may assist to identify the vehicle with its estimated NOx emissions value.

The website also provides information on NOx and examples of VRT calculations.

What impact if the NOx levy likely to have?

The nitrogen oxide (NOx) emissions-based charge is welcomed taxation as it could reduce the number of older used imports coming into Ireland. Since 2016 there has been over 150,000 imported cars that do not meet the latest EU emission standards, which in effect means Ireland has become the dumping ground for older cars the UK doesn’t want. This is bad news for Ireland’s environment. The introduction of the NOx charge will impact on older higher emitting used imports which, unlike the previous diesel surcharge, will penalise older cars with higher levels of pollutants.

European 'Euro' Emissions Standards

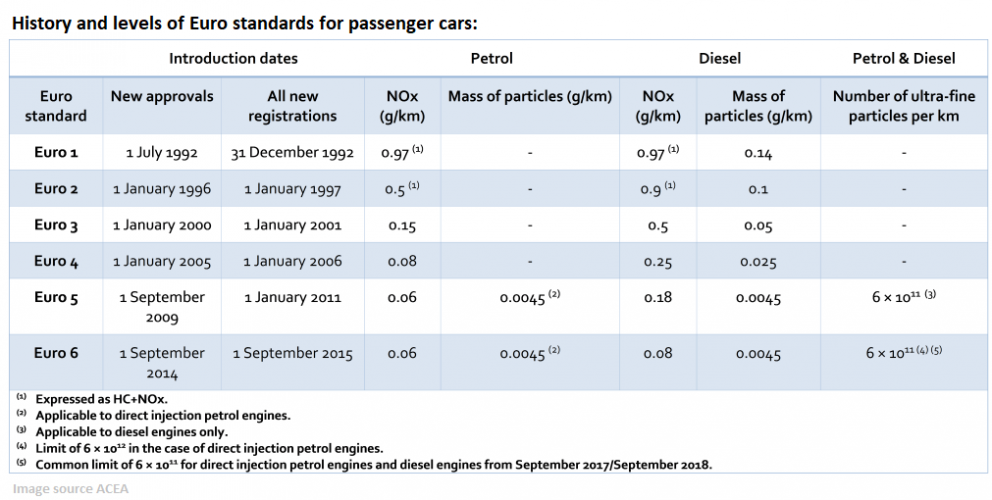

The European Union set emission regulations, with the aim of improving air quality, on cars and commercial vehicles sold in Europe. European emission standards define the acceptable limits for exhaust emissions of new vehicles sold in the European Union and EEA member states. The emission regulations set strict limits on emissions from tailpipe pollutants and from other sources on the vehicle, e.g. evaporative emissions from the fuelling system.

What are Euro Emission Standards?

Although there were previous emission regulations, the starting point for the Euro emissions standard referred to as ‘Euro standards’ was 1991 with ‘Euro 0’ ‘Euro 0' (Arabic numerals) for passenger cars and in 1992 with ‘Euro I' (Roman numerals) for commercial vehicles.

In 1992 Euro 1 saw the introduction of catalytic converters become compulsory on new cars. There have been a series of Euro emissions standards since then, with Euro 6 the current standard. Euro 6 was introduced on 1st September 2014 and was rolled out on vehicles registered in September 2015.

The aim of Euro emissions standards is to reduce the levels of harmful exhaust emissions chiefly:

- Nitrogen oxides (NOx)

- Carbon monoxide (CO)

- Hydrocarbons (HC)

- Particulate matter (PM)

Over time innovation and technologies have contributed to improvements in engine management systems and exhaust after-treatment systems, which have helped meet progressively tighter emission standards. Under the Euro 6/VI standards all new diesel cars and all new trucks are now fitted with particulate filters. Many commercial vehicles also use Selective Catalytic Reduction (SCR) in combination with a urea-based additive (trademark AdBlue®) to help reduce NOx emissions.

Euro Emission Checker

You can normally work out what your car's Euro standard is from its age but there are other factors which can contribute too. Check with the manufacturer to be certain. The table below acts as a guide to show how the different Euro emissions categories are applied to new vehicle models approved after a specific date.

|

Car Newly Registered from: |

Emissions Standard |

|

31 December 1992 |

Euro 1 |

|

1 January 1997 |

Euro 2 |

|

1 January 2001 |

Euro 3 |

|

1 January 2006 |

Euro 4 |

|

1 January 2011 |

Euro 5 |

|

1 September 2015*see note |

Euro 6 |

*The table is a guide and it is recommended you contact the vehicle manufacturer to check your car’s standard is if you are unsure.

Worldwide Harmonised Light Vehicle Test Procedure

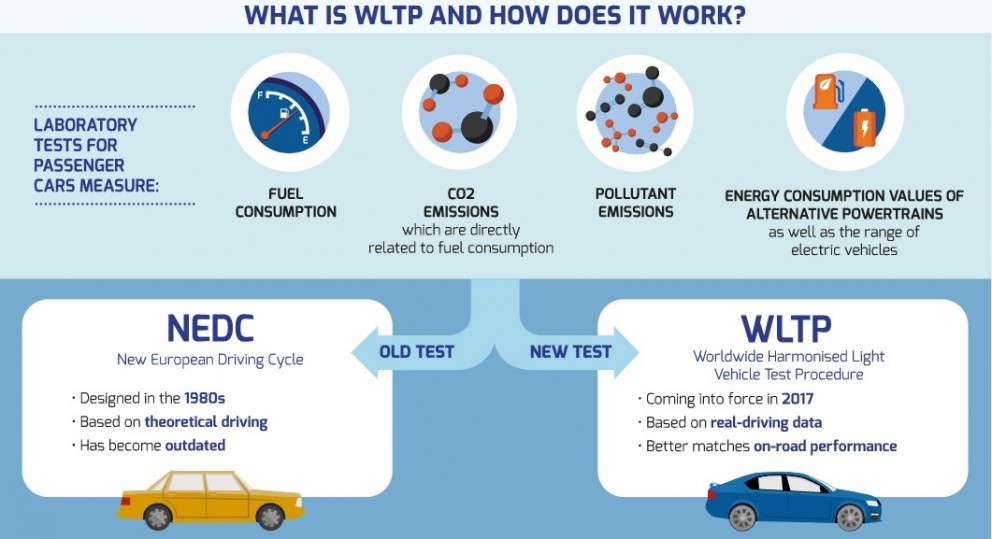

The Worldwide Harmonised Light Vehicle Test Procedure (WLTP) laboratory test is used to measure fuel consumption and CO2 emissions from passenger cars, as well as their pollutant emissions.

What is WLTP and how does it work?

- Every new car placed on the market must undergo a test, WLTP is a new type of test. Under EU law, the Worldwide Harmonised Light Vehicle Test Procedure (WLTP) laboratory test is used to measure fuel consumption and CO2 emissions from passenger cars, as well as their pollutant emissions. The new test is designed to be far more stringent, requiring vehicle engines to replicate far more demanding and strenuous driving; as a result, the CO2 values delivered under the test have always been expected to be higher.

- From September 2017, the old NEDC (New European Driving Cycle) lab test for cars was replaced by the new WLTP test. The same car can go through both tests and will have higher emissions recorded on the new test. September 1st 2018 Vehicle Manufacturers had to ensure that all new Cars and Light Commercial Vehicles placed on the market have been tested under the new WLTP test. From the start of 2019 WLTP fuel consumption and CO2 emission values have been used for consumer information purposes.

Image source ACEA

The old NEDC test was based on a theoretical driving profile, while WLTP uses real-driving data.

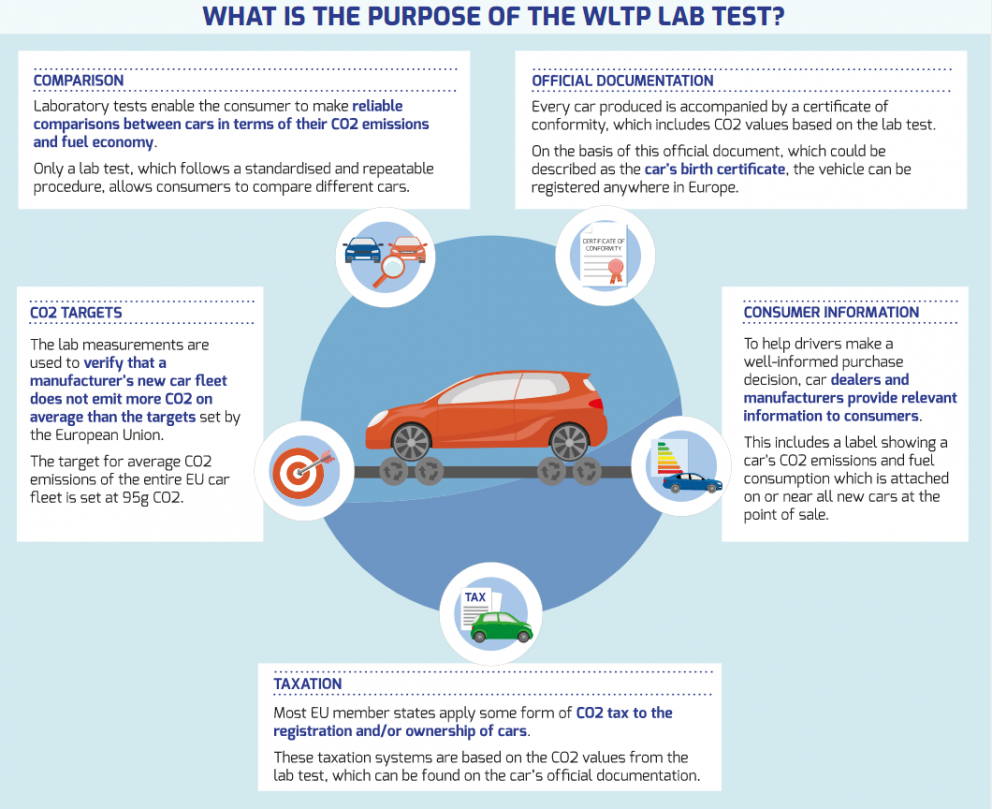

What is the purpose of the WLTP Lab Test?

Image source ACEA

What does WLTP mean for the motorist

WLTP will be the basis for taxation for cars from January 2021. The new test is designed to be far more stringent, requiring vehicle engines during its lab test to replicate far more demanding and strenuous driving. As a result, the CO2 values delivered under the test have always been expected to be higher.

WLTP Test (more rigorous test) will produce higher CO2 value than older NEDC Test.

Ireland’s Registration Tax (VRT) & Road Tax will move from the older NEDC emissions test to WLTP Jan 2021.

It was never intended that consumers should have to pay increased taxes as a result of this changeover and indeed the EU Commission has already commented on this, while noting that Taxation is a matter for each Member State: "It should be noted that the introduction of WLTP does not necessarily result in higher car taxes... if the adjustment of national car taxation schemes takes account of the expected increase in CO2 emissions under WLTP."

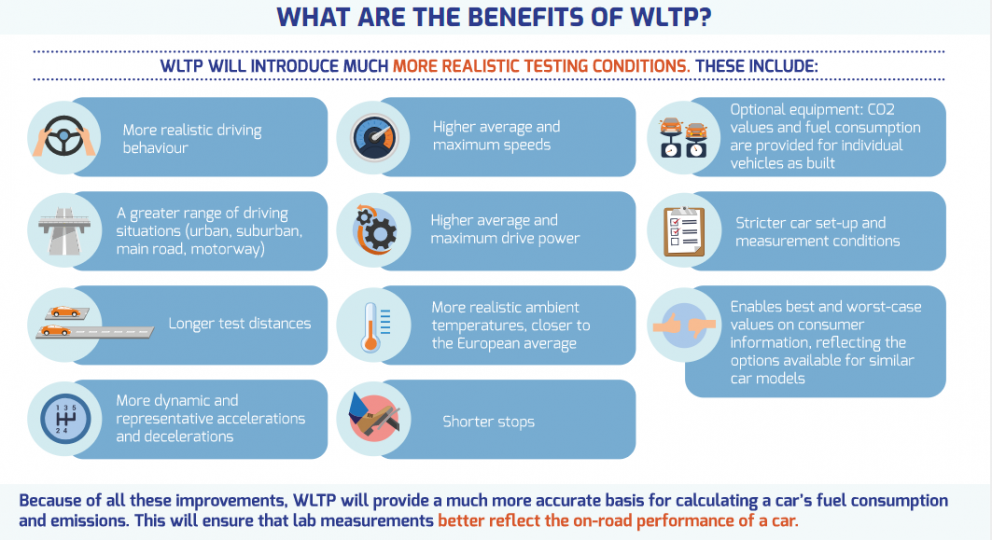

What are the benefits of WLTP

Image source ACEA

· The WLTP test will facilitate more realistic driving conditions which will include,

- More realistic driving behaviour;

- A greater range of driving situations (urban, suburban, main road, motorway);

- Longer test distances;

- More realistic ambient temperatures, closer to the European average;

- Higher average and maximum speeds;

- Higher average and maximum drive power;

- More dynamic and representative accelerations and decelerations;

- Shorter stops;

- Optional equipment: CO2 values and fuel consumption are provided for individual vehicles as built;

- Stricter car set-up and measurement conditions;

- Enables best and worst-case values on consumer information, reflecting the options available for similar car models.