182 Registrations only slightly down on July 2017

- 182 July car sales (26,944) on July 2017 (27,707) -2.75%

- New car registrations 2018, totalled 114,059 -4.09% on 2017

- 2018 forecast of new car sales at around 125,000 -4.8% on 2017,Used import market 104,660 +12%

- €985.9 Million Exchequer contribution from car sales first half of 2018 1.9% increase on first half of 2017

- Cost of Motoring: Average price of a new car down 1.9% on June 2017, Petrol prices up 9.7%, Diesel prices up 12.2.% on June 2017, Insurance Costs decline 20.7% since July 2016. Average motor insurance costs declined 11.5% since June 2017.

The Society of the Irish Motor Industry (SIMI) today issued the official 182 new vehicle registration figures for July along with their second Quarterly Motor Industry Review of 2018.

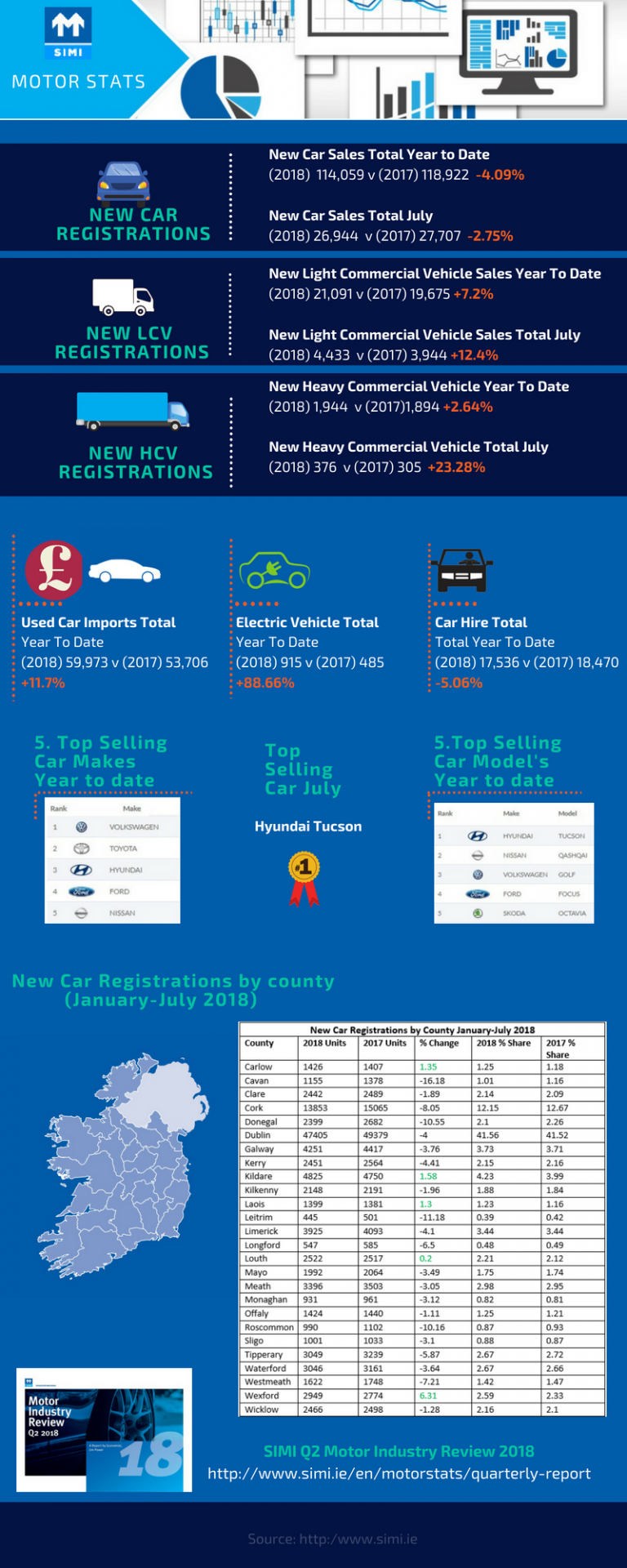

Car sales figures for the month of July show that 182 registrations are down 2.75% (26,944) compared to July 2017 (27,707). Light Commercials are currently up 12.4% (4,433) compared to July last year (3,944), while Heavy Commercial Vehicle registrations were also up 23.28% (376) in comparison to July 2017 (305).

The report highlights that while Ireland’s economic indicators continue to evolve in a positive manner, pointing towards an expanding economy, as consumer spending continues to improve at a steady rate, the depreciation in the value of sterling since the end of 2015 has made life more difficult for the Irish motor trade, with new car sales been displaced by used imports from the UK.

Used car imports have increased by 11.7% year to date, aided by the weakness in sterling, as the Motor Industry continues to experience significant uncertainty, with monthly declines in new car registrations figures, reflecting the substantial impact of Brexit.

Other noticeable trends within the market place show that the average price of a new car in June 2018 was 1.9% lower than a year earlier, while car buyers are paying 4.1% more for higher specifications cars. The recent move away from diesel towards petrol has result in the average C02 emissions from new car sales seeing a slight increase. While Motor insurance costs in the year to June declining 11.5%, and insurance costs are down 20.7% since July 2016. Fuel prices have seen an increase with Petrol prices up 9.7%, Diesel prices up 12.2% on June 2017.

Looking ahead to the remainder of 2018 Jim Power, Economist and author of the SIMI Report said: “The economic fundamentals that underpin new car registrations look set to remain positive but continued strong growth in used imports will continue to undermine new car sales. For 2018, the used import market is projected to grow by around 12% to reach 104,660. New car registrations in 2018 are forecast at around 125,000, which would represent a decline of 4.8% on the 2017 outturn.”

Alan Nolan, Director General, SIMI commented: “The 182 sales period has been a good month with new car registrations only slightly down on the same period last year, while registrations in the commercial sector in particular are showing positive signs of growth, with businesses investing in the renewal of their fleets. Electric vehicle registrations have seen a marked increased despite currently only holding small percentage of the marketplace and will continue to grow over the coming years."

Ends

Notes to Editor

Downloads

Click here to download SIMI Motor Industry Review Q2 2018

Sound Bites from Economist Jim Power

Clip 1: Comment on Economy and new car sales

Clip 2:Comment on Used Imports

July 182 Registrations Infographic (as per below) available pdf/png

182 July New Car Sales Stats

- New car sales year to date (2018) 114,059 v (2017) 118,922 -4.09%

- New car sales total July (2018) 26,944 v (2017) 27,707 -2.75%

- Light Commercial Vehicle sales year to date (2018) 21,091 v (2017) 19,675 +7.2%

- Light Commercial Vehicle sales total July (2018) 4,433 v (2017) 3,944 +12.4%

- Heavy Commercial Vehicle total sales year to date (2018) 1,944 v (2017) 1,894 +2.64%

- Heavy Commercial Vehicle sales total July (2018) 376 v (2017) 305 +23.28%

- Used Car Imports year to date (2018) 59,973 v (2017) 53,706 +11.67%

- Used Car Imports total July (2018) 8,096 v (2017) 7,704 +5.09%

- Electric Vehicles total (2018) 915 v (2017) 485 +88.66%

- Electric Vehicles total July (2018 ) 386 v (2017) 111 +247.75%

- Car Hire total year to date (2018) 17,536 v (2017)18,470 -5.06%

- Car Hire total July (2018) 3,954 v (2017) 5,012 -21.11%

- 5 Top Selling Car Brands Year to Date were: 1. Volkswagen, 2. Toyota 3. Hyundai 4. Ford 5.Nissan

- 5 Top car model’s year to date were: 1. Hyundai Tucson 2 Nissan Qashqai 3 Volkswagen Golf 4.Ford Focus 5 Skoda Octavia

- Top Selling Car July: Hyundai Tucson

| New Car Registrations by County January-July 2018 | |||||

| County | 2018 Units | 2017 Units | % Change | 2018 % Share | 2017 % Share |

| Carlow | 1426 | 1407 | 1.35 | 1.25 | 1.18 |

| Cavan | 1155 | 1378 | -16.18 | 1.01 | 1.16 |

| Clare | 2442 | 2489 | -1.89 | 2.14 | 2.09 |

| Cork | 13853 | 15065 | -8.05 | 12.15 | 12.67 |

| Donegal | 2399 | 2682 | -10.55 | 2.1 | 2.26 |

| Dublin | 47405 | 49379 | -4 | 41.56 | 41.52 |

| Galway | 4251 | 4417 | -3.76 | 3.73 | 3.71 |

| Kerry | 2451 | 2564 | -4.41 | 2.15 | 2.16 |

| Kildare | 4825 | 4750 | 1.58 | 4.23 | 3.99 |

| Kilkenny | 2148 | 2191 | -1.96 | 1.88 | 1.84 |

| Laois | 1399 | 1381 | 1.3 | 1.23 | 1.16 |

| Leitrim | 445 | 501 | -11.18 | 0.39 | 0.42 |

| Limerick | 3925 | 4093 | -4.1 | 3.44 | 3.44 |

| Longford | 547 | 585 | -6.5 | 0.48 | 0.49 |

| Louth | 2522 | 2517 | 0.2 | 2.21 | 2.12 |

| Mayo | 1992 | 2064 | -3.49 | 1.75 | 1.74 |

| Meath | 3396 | 3503 | -3.05 | 2.98 | 2.95 |

| Monaghan | 931 | 961 | -3.12 | 0.82 | 0.81 |

| Offaly | 1424 | 1440 | -1.11 | 1.25 | 1.21 |

| Roscommon | 990 | 1102 | -10.16 | 0.87 | 0.93 |

| Sligo | 1001 | 1033 | -3.1 | 0.88 | 0.87 |

| Tipperary | 3049 | 3239 | -5.87 | 2.67 | 2.72 |

| Waterford | 3046 | 3161 | -3.64 | 2.67 | 2.66 |

| Westmeath | 1622 | 1748 | -7.21 | 1.42 | 1.47 |

| Wexford | 2949 | 2774 | 6.31 | 2.59 | 2.33 |

| Wicklow | 2466 | 2498 | -1.28 | 2.16 | 2.1 |

Statistical information available https://stats.beepbeep.ie

For further information:

Contact: Teresa Noone, PR & Marketing Manager, SIMI 01 6761690 or email tnoone@simi.ie