Disappointing July New Car Registrations down 17.3%: Incentivisation key, Electric Vehicle supports must be retained

- 21,902 new cars registrations for July compared to 26,477 in July 2021 (-17.3%) and 24,681 in July 2019 (-11.3%) pre-Covid levels.

- 87,075 new cars registered year to date compared to 90,330 for the same period in 2021 (-3.6%) and 105,439 behind that of pre-Covid levels in 2019 (-17.4%).

The Society of the Irish Motor Industry (SIMI), today released the official 222 new vehicle registration figures for July.

New car registrations for July were down 17.3% (21,902) when compared to July 2021 (26,477), while year to date registrations are down 3.6% (87,075) on the same period last year (90,330).

Light Commercials vehicles (LCV) are down 14.8% (4,039) compared to July last year (4,740) and year to date are down 21.4% (17,100). HGV (Heavy Goods Vehicle) registrations are down 1.6% (317) in comparison to July 2021 (322). Year to date HGV's are down 9.4% (1,675).

Used car imports for July(4,206) have seen a decrease of 21.3% on July 2021 (5,344). Year to date imports are down 31.1% (28,316) on 2021 (41,097).

For the month of July 2,738 new electric vehicles were registered compared to 1,895 in July 2021. So far this year 11,182 new electric cars have been registered in comparison to 6,225 on the same period 2021 an increase of 79.6%.

Electric Vehicle, Plug-in Hybrids and Hybrids continue to increase their market share, with a combined market share now of 40.9%. Petrol continues to remain dominant with 29.29%, Diesel accounts for 27.51%, Hybrid 21.23%, Electric 12.84% and Plug-in Electric Hybrid 6.83%.

Commenting on the new vehicle registrations Brian Cooke, Director General SIMI said:

“Disappointingly July new car registrations, our second highest sales’ period, are down 17.3% on July 2021. This means the new car market is now 4% behind year to date and 17% behind pre-COVID 2019. The electric vehicle segment continues to grow, both in quantum and as a proportion of the new car market, with an 80% year on year growth and a market share of 13%. While it appears that there is appetite among consumers for both new and used cars, supply issues are hampering overall activity. The impact of this is another year of below par performance in the Irish new car market, which results in the Irish car fleet continuing to get older. The underlying new car market needs to grow significantly over the next few years if we are to optimise transport emission reductions. Government policies must contain the right measures, to support and encourage the change to lower and zero emitting vehicles. Reducing EV supports or increasing taxation will only act as a barrier to change and add to the cost of living. In this context, SIMI is asking the Government to continue its support for the EV project by extending EV supports at current levels out to 2025 and to resist any VRT increases in Budget 2023 which will only prove counterproductive and prevent us dealing with the legacy fleet in an effective manner that supports a just transition.”

2022 Total New Vehicle Stats

- New Car sales total year to date (2022) 87,075 v (2021) 90,330 -3.6%

- New Car sales total year to date (2022) 87,075 v (2019) 105,439 -17.4%

- New Car sales total July (2022) 21,902 v (2021) 26,477 -17.3%

- New Car sales total July (2022) 21,902 v (2019) 24,681 -11.3%

- Light Commercial Vehicles sales year to date (2022) 17,100 v (2021) 21,763 -21.4%

- Light Commercial Vehicles sales year to date (2022) 17,100 v (2019) 20,014 -14.6%

- Light Commercial Vehicles sales total July (2022) 4,039 v (2021) 4,740 -14.8%

- Light Commercial Vehicles sales total July (2022) 4,039 v (2019) 4,697 -14.0%

- Heavy Goods Vehicle total sales year to date (2022) 1,675 v (2021) 1,849 -9.4%

- Heavy Goods Vehicle total sales year to date (2022) 1,675 v (2019) 2,054 -18.5%

- Heavy Goods Vehicle total sales July (2022) 317 v (2021) 322 -1.6%

- Heavy Goods Vehicle total sales July (2022) 317 v (2019) 251 +26.3%

- Used Car Imports total year to date (2022) 28,316 v (2021) 41,097 -31.1%

- Used Car Imports total year to date (2022) 28,316 v (2019) 62,508 -54.7%

- Used Car Imports total July (2022) 4,206 v (2021) 5,344 -21.3%

- Used Car Imports total July (2022) 4,206 v (2019) 9,382 -55.2%

- Car Hire total year to date (2022) 3,896 v (2021)7,577 -48.6%

- Car Hire total year to date (2022) 3,896 v (2019) 18,266 -78.7%

- Car Hire total July (2022) 1,169 v (2021) 3,940 -70.3%

- Car Hire total July (2022) 1,169 v (2019) 3,854 -69.7%

- New Electric Vehicles sales total year to date (2022) 11,182 v (2021) 6,225 +79.6%

- New Electric Vehicles sales total year to date (2022) 11,182 v (2019) 2,687 +316.2%

- New Electric Vehicles sales July (2022) 2,738 v (2021) 1,895 +44.5%

- New Electric Vehicles sales July (2022) 2,738 v (2019) 733 +273.5%

- 5 Top selling car brands year to date are: 1. TOYOTA, 2. HYUNDAI, 3. VOLKSWAGEN, 4.KIA, 5. SKODA

- 5 Top car model’s year to date are 1. HYUNDAI TUCSON, 2. TOYOTA COROLLA, 3. TOYOTA C-HR, 4.KIA SPORTAGE, 5. TOYOTA RAV 4

- Top Selling Car July 2022: HYUNDAI TUCSON

- 5 Top new Electric Vehicle car model’s year to date are: 1 VOLKSWAGEN ID.4, 2. HYUNDAI IONIQ 5, 3. KIA EV6, 4. VOLKSWAGEN ID.3, 5. NISSAN LEAF

- Market share by engine type 2022: Petrol 29.29%, Diesel 27.51%, Hybrid 21.23%, Electric 12.84%, Plug-In Electric Hybrid 6.83%

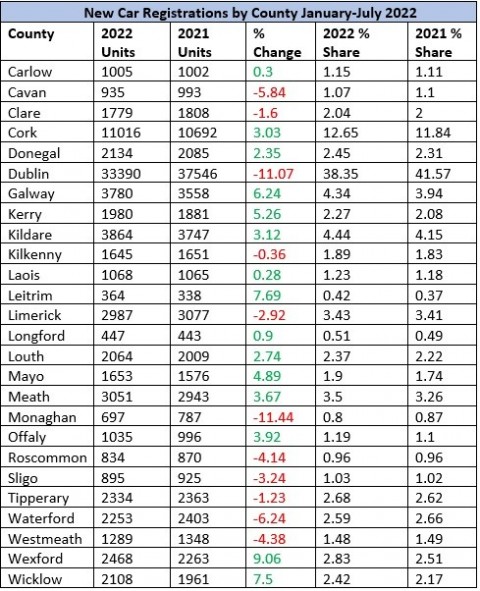

- New car registrations by county for January-July 2022. Click here to download