May 10% decline new car registrations, Electric cars double growth year to date

The Society of the Irish Motor Industry (SIMI), today released the official 221 new vehicle registration figures for May.

New car registrations for May were down 10.3% (5,303) when compared to May 2021 (5,914). Registrations year to date are up 3.2% (63,045) on the same period last year (61,091) and are -20.5% behind (79,350) that of pre-Covid levels.

Light Commercials vehicles (LCV) are down 37.4% (1,449) compared to May last year (2,316) and year to date are down 22.5% (12,431). HGV (Heavy Goods Vehicle) registrations are up 9.5% (219) in comparison to May 2021 (200). Year to date HGV's are down 12.4% (1,248).

Used car imports for May (3,905) have seen a decrease of 35.2% on May 2021 (6,029). Year to date imports are down 34.4% (19,769) on 2021 (30,124).

For the month of May 744 new electric vehicles were registered compared to 534 in May 2021. So far this year 8,261 new electric cars have been registered in comparison to 3,940 on the same period 2021.

Electric Vehicle, Plug-in Hybrids and Hybrids continue to increase their market share, with a combined market share now of 43.14%. Petrol continues to remain dominant with 27.96%, Diesel accounts for 26.46%, Hybrid 22.87%, Electric 13.10% and Plug-in Electric Hybrid 7.17%.

Commenting on the new vehicle registrations Brian Cooke, Director General SIMI said:

“New vehicle registrations continue to remain challenging, with a slowdown during the month of May, reflecting the international supply chain issues. New car registrations year to date are over 20% behind pre-COVID (2019) levels, while sales of commercial vehicles, both Light and Heavy Good Vehicles (HGVs), also remain subdued. Despite the decline in May new car registrations, the sale of electric cars continues to grow, with EV sales for the first 5 months of the year over double that of the same period last year.

The EPA today have highlighted the huge challenges in meeting emissions reductions required by 2030. For transport this means increased investment in active and public transport, and also rapidly reducing emissions from the national vehicle fleet by accelerating the move to electrification and dealing with the legacy fleet. In this context, the Industry and consumers will need confidence that both the current levels of EV supports are continued, and that Government support the massive investment required to create a charging infrastructure that keeps pace on an ongoing basis with the increasing numbers of EVs.”

2022 Total New Vehicle Stats

- New Car sales total year to date (2022) 63,045 v (2021) 61,091 +3.2%

- New Car sales total year to date (2022) 63,045 v (2019) 79,350 -20.55%

- New Car sales total May (2022) 5,303 v (2021) 5,914 -10.3%

- New Car sales total May (2022) 5,303 v (2019) 6,320 -16.09%

- Light Commercial Vehicles sales year to date (2022) 12,431 v (2021) 16,035 -22.5%

- Light Commercial Vehicles sales year to date (2022) 12,431 v (2019) 14,570 -14.7%

- Light Commercial Vehicles sales total May (2022)1,449 v (2021) 2,316 -37.4%

- Light Commercial Vehicles sales total May (2022)1,449 v (2019) 1,717 -15.6%

- Heavy Goods Vehicle total sales year to date (2022) 1,248 v (2021) 1,425 -12.4%

- Heavy Goods Vehicle total sales year to date (2022) 1,248 v (2019) 1,487 -16.1%

- Heavy Goods Vehicle total sales May (2022) 219 v (2021) 200 +9.5%

- Heavy Goods Vehicle total sales May (2022) 219 v (2019) 298 -26.5%

- Used Car Imports total year to date (2022) 19,769 v (2021) 30,124 -34.4%

- Used Car Imports total year to date (2022) 19,769 v (2019) 45,066 -56.1%

- Used Car Imports total May (2022) 3,905 v (2021) 6,029 -35.2%

- Used Car Imports total May (2022) 3,095 v (2019) 9,347 -58.2%

- New Electric Vehicles sales total year to date (2022) 8,261 (2021) 3,940 +109.67%

- New Electric Vehicles sales total year to date (2022) 8,261 v (2019) 1,901 +334.56%

- New Electric Vehicles sales May (2022) 744 v (2021) 534 +39.3%

- New Electric Vehicles sales May (2022) 744 v (2019) 171 +335.09%

- 5 Top selling car brands year to date are: 1. TOYOTA 2. HYUNDAI 3. VOLKSWAGEN 4. KIA, 5. SKODA

- 5 Top car model’s year to date are 1. HYUNDAI TUCSON, 2. TOYOTA COROLLA, 3. TOYOTA C-HR, 4. TOYOTA RAV 4, 5. TOYOTA YARIS

- Top Selling Car May 2022: TOYOTA COROLLA

- 5 Top new Electric Vehicle car model’s year to date: 1. VOLKSWAGEN ID.4, 2. HYUNDAI IONIQ 5, 3. KIA EV6, 4. NISSAN LEAF, 5. TESLA MODEL 3

- Market share by engine type 2022: Petrol 27.96%, Diesel 26.46%, Hybrid 22.87%, Electric 13.10%, Plug-In Electric Hybrid 7.17%

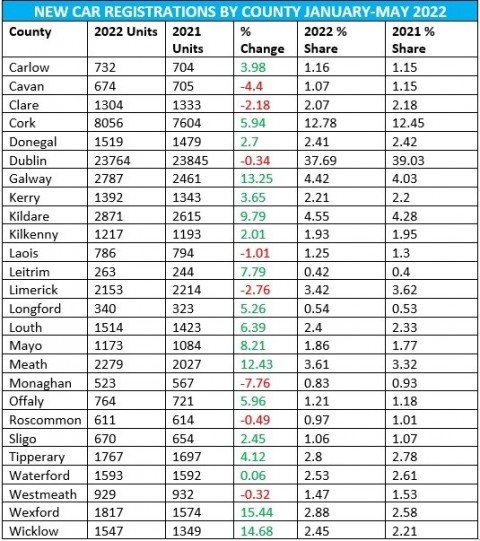

- Table below shows new car registrations by county for January-May 2022. Click here to download pdf also.