MOTOR INDUSTRY OPTIMISTIC 212 REGISTRATION PLATE COMMENCES

- 2,767 new cars registrations for the month of June compared to 1,006 in June 2020 and 1,408 in June 2019.

- 63,867 new cars registered year to date compared to 52,885 for the same period in 2020 (+20.8%) and 80,758 in 2019 (-20.9%).

The Society of the Irish Motor Industry (SIMI) today released their official new vehicle statistics. To present a more accurate picture of the new vehicle registrations, it is important to compare registrations totals with the same period in 2019 (pre-COVID) when businesses were fully operational.

Light Commercials Vehicles (LCV) seen an increase of 992 registrations compared to June last year 569 and 747 for the same month in 2019. Year to date 17,027 new LCVs were registered an increase on last year’s 10,569 (+61.1%) and on 15,317 in 2019 (+11.2%).

Heavy Goods Vehicles (HGV) seen 102 registrations in June when compared to 100 in June 2020 and 316 June 2019. Year to date HGV's registrations total 1,527 compared with 1,199 in 2020 (+27.4%) and 1,803 in 2019 (-15.3%).

5,631 used cars were imported in June 2021, compared with 4,263 imports in June 2020, a decrease on the 8,060 imports in June 2019. Year to date used imports are up 56.9% (35,754) on 2020 (22,787) and down 32.8% on 2019 (53,126).

For the month of June 390 new electric vehicles were registered compared to 42 in June 2020. So far this year 4,333 new electric cars have been registered in comparison to 1,889 on the same period 2020. Electric Vehicle and Plug-in Hybrids and Hybrids continue to increase their market share, with their combined market share now over 29.66%. Diesel now accounts for 36.08%, Petrol 31.79%, Hybrid 16.51%, Electric 6.78% and Plug-in Electric Hybrid 6.37%.

Brian Cooke, SIMI Director General commenting:

“The last fifteen months has been for the Motor Industry a hugely difficult time, with new car sales down over a fifth when compared to pre COVID 2019. Today July 1st, with the new 212 registration plate, will hopefully be a turning point for the Industry and with both the lead-in time provided by the re-opening of showrooms and a strong order bank, retailers are optimistic that they can recover some of the sales lost during the first half of the year. Notwithstanding this the impact of COVID will continue for the sector, as due to the concerns over the short-term outlook for international tourism there continues to be a lack of demand in the car hire market. On a more positive note, the demand for both Commercial Vehicles and Electric Vehicles is very encouraging. In this context it is vital that the current EV incentives are extended beyond their expiry dates as the country begins its transition to zero emissions transport.”

2021 Total New Vehicle Stats

- New Car sales total year to date (2021) 63,867 v (2020) 52,885 +20.8%

- New Car sales total year to date (2021) 63,867 v (2019) 80,758 -20.9%

- New Car sales total June (2021) 2,767 v (2020) 1,006 +175.0%

- New Car sales total June (2021) 2,767 v (2019) 1,408 +96.52%

- Light Commercial Vehicles sales year to date (2021) 17,027 v (2020) 10,569 +61.1%

- Light Commercial Vehicles sales year to date (2021) 17,027 v (2019) 15,317 +11.2%

- Light Commercial Vehicles sales total June (2021) 992 v (2020) 569 +74.3%

- Light Commercial Vehicles sales total June (2021) 992 v (2019) 747 +32.8%

- Heavy Goods Vehicle total sales year to date (2021) 1,527 v (2020) 1,199 +27.4%

- Heavy Goods Vehicle total sales year to date (2021) 1,527 v (2019) 1,803 -15.3%

- Heavy Goods Vehicle total sales June (2021) 102 v (2020) 100 +2.0%

- Heavy Goods Vehicle total sales June (2021) 102 v (2019) 316 -67.7%

- Used Car Imports total year to date (2021) 35,754 v (2020) 22,787 +56.9%

- Used Car Imports total year to date (2021) 35,754 v (2019) 53,126 -32.7%

- Used Car Imports total June (2021) 5,631 v (2020) 4,263 +32.1%

- Used Car Imports total June (2021) 5,631 v (2019) 8,060 -30.1%

- New Electric Vehicles sales total year to date (2021) 4,333 v (2020) 1,889 +129.4%

- New Electric Vehicles sales total year to date (2021) 4,333 v (2019) 1,954 +121.8%

- New Electric Vehicles sales June (2021) 390 v (2020) 42 +828.6%

- New Electric Vehicles sales June (2021) 390 v (2019) 53 +635.8%

- 5 Top Selling Car Brands June 2021 were: 1. Toyota 2. Volkswagen 3. Hyundai 4. Skoda 5. Ford

- 5 Top car model’s year June 2021 were: 1. Hyundai Tucson, 2. Toyota Corolla 3. Toyota Rav 4, 4. Volkswagen Tiguan 5. Skoda Octavia

- Top Selling Car June 2021: Hyundai Tucson

- Market share by engine type 2021: Diesel 36.08%, Petrol 31.79%, Hybrid 16.51%, Electric 6.78% and Plug-in Electric Hybrid 6.37%

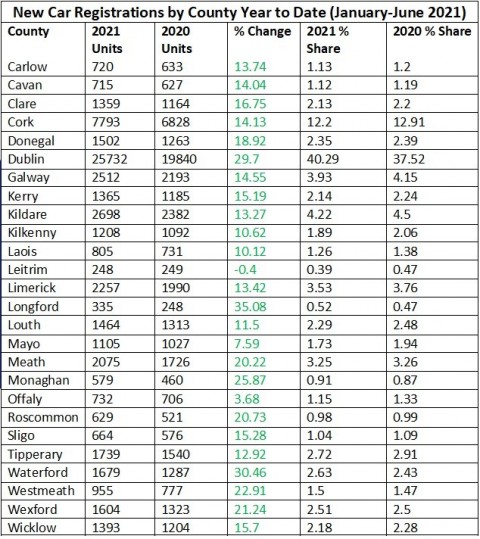

- Table shows new car registrations by county for January-June 2021 Click Here to download.

For more stats information visit https://stats.beepbeep.ie/